บัตรเครดิต

สินเชื่อบุคคล

โปรโมชั่น

โปรโมชั่น

ธุรกิจร้านค้า

บริการท่องเที่ยว

บริการท่องเที่ยว  ช้อปสินค้าออนไลน์

ช้อปสินค้าออนไลน์

บริการลูกค้า

EN

TH

โปรโมชั่น

โปรโมชั่น

บริการท่องเที่ยว

บริการท่องเที่ยว  ช้อปสินค้าออนไลน์

ช้อปสินค้าออนไลน์

EN

TH

สมัครง่าย ไม่ต้องค้ำ

เพียงสมัครออนไลน์ด้วยตนเอง

เวลา 8.00-19.30 น. และใช้บริการเบิกถอนเงินก้อนแรก

ไม่มีค่าธรรมเนียมรายปี

และค่าธรรมเนียมการเบิกถอนเงินสด

ชำระเต็มจำนวน หรือ ชำระขั้นต่ำ 3%

แต่ไม่ต่ำกว่า 300 บาท

รูดซื้อ

ช้อปสะดวกที่ร้านค้า และช้อปออนไลน์กดเงิน

ที่ตู้ ATM ทั่วไทย ฟรีค่าธรรมเนียมผ่อนสินค้า

ใช้บัตรผ่อนสินค้าและบริการ ด้วยอัตราสะดวก รวดเร็ว ง่ายๆ ผ่าน แอป KTC Mobile

หมายเหตุ: เงื่อนไขเป็นไปตามที่บริษัทฯกำหนด

รูดซื้อ

ช้อปสะดวกที่ร้านค้า และช้อปออนไลน์ ได้ทั่วโลกกดเงิน

เงินที่ตู้ ATM ทั่วไทย ฟรีค่าธรรมเนียมผ่อนสินค้า

ใช้บัตรผ่อนสินค้าและบริการ ด้วยอัตรา

สะดวก รวดเร็ว ง่ายๆ ผ่านแอป KTC Mobile

หมายเหตุ: เงื่อนไขเป็นไปตามที่บริษัทฯกำหนด

เพียงเตรียมบัตรประชาชนตัวจริง และไฟล์เอกสารแสดงรายได้ แล้วทำตามขั้นตอนนี้ได้เลย

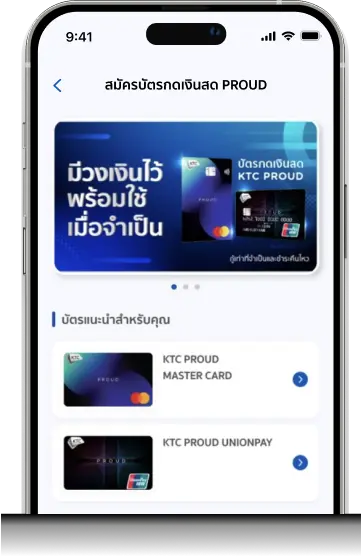

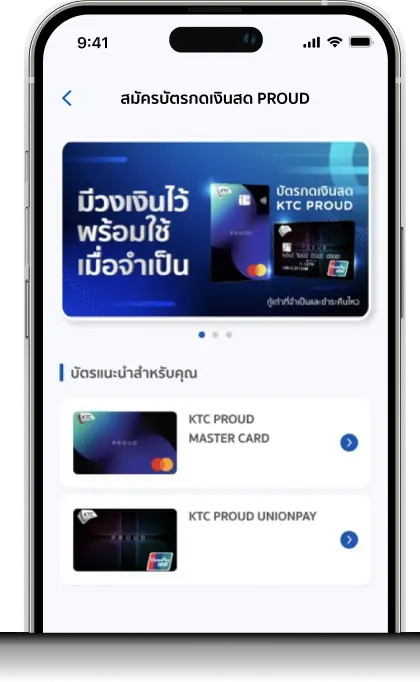

เลือก “สมัครผลิตภัณฑ์”

แล้วเลือกบัตรที่ต้องการสมัคร

กรณีสมัครไม่เสร็จในคราวเดียว สามารถกลับมาทำรายการต่อโดยเลือก “เข้าสู่ระบบ เพื่อทำรายการสมัครต่อ”

ถ่ายภาพและยืนยัน

ข้อมูลบัตรประชาชน

บัตรประชาชนที่ใช้ต้องเห็นข้อมูลบนบัตรชัดเจน

และยังไม่หมดอายุ

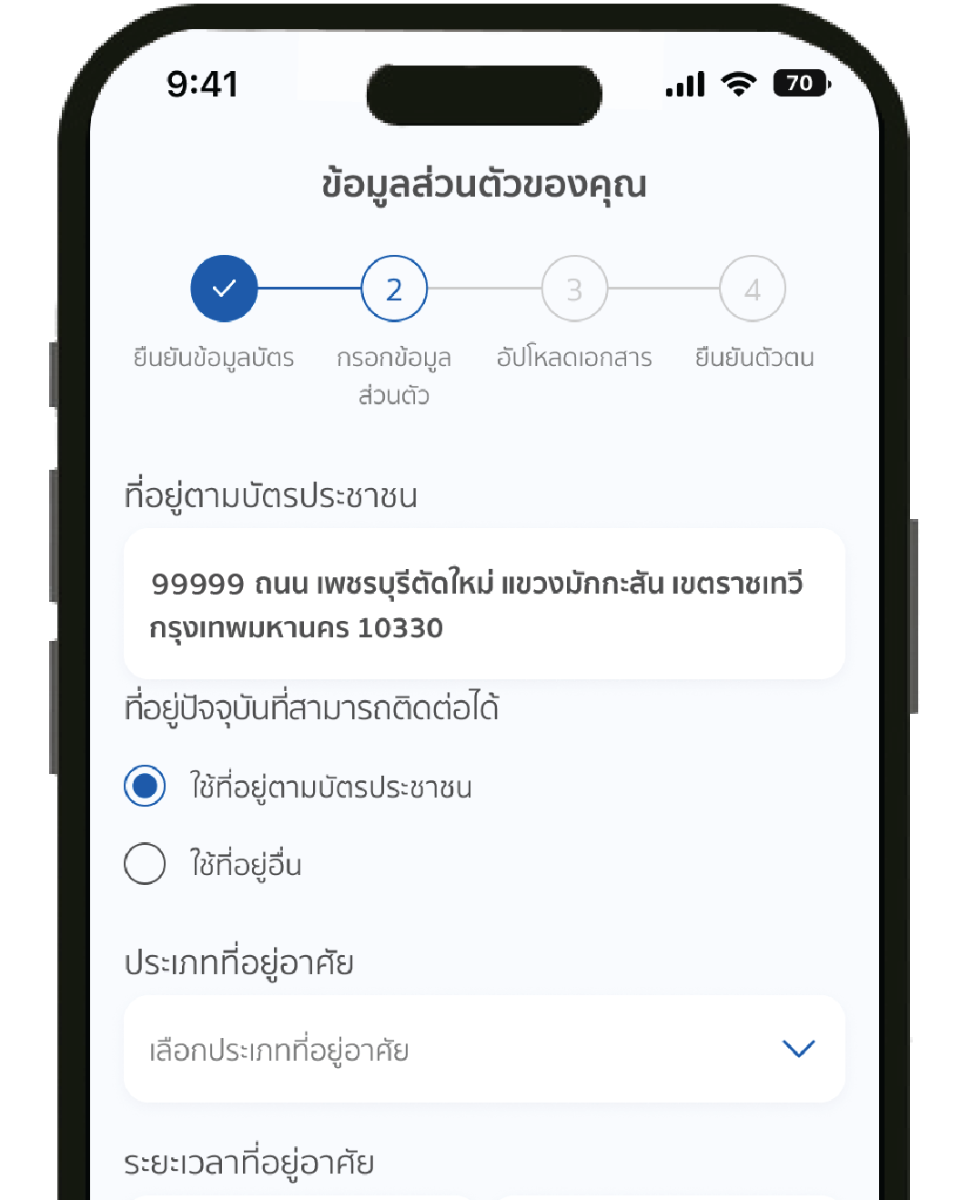

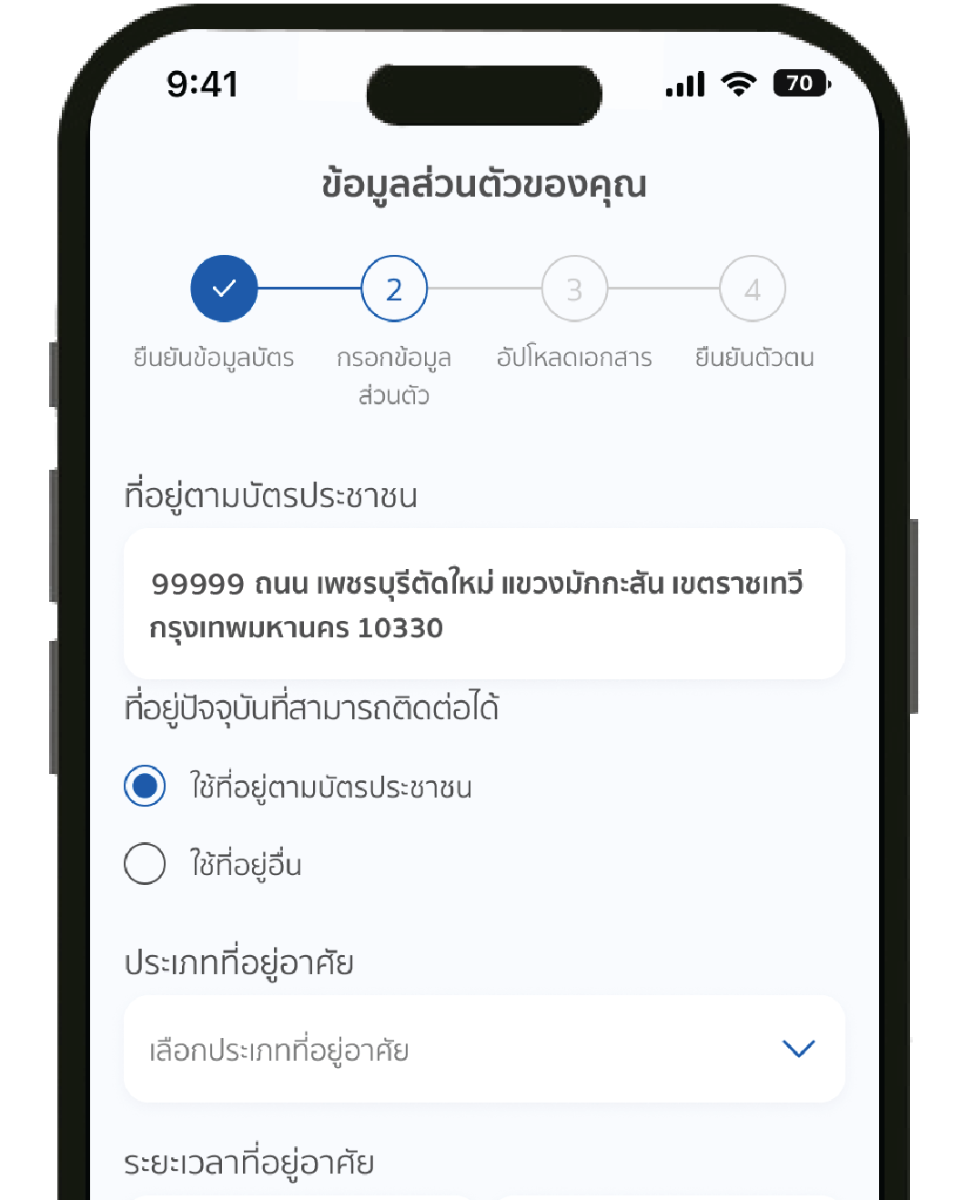

กรอกข้อมูลที่อยู่

และข้อมูลส่วนตัว

กรอกข้อมูลให้ถูกต้องครบถ้วนตามที่ระบบต้องการ

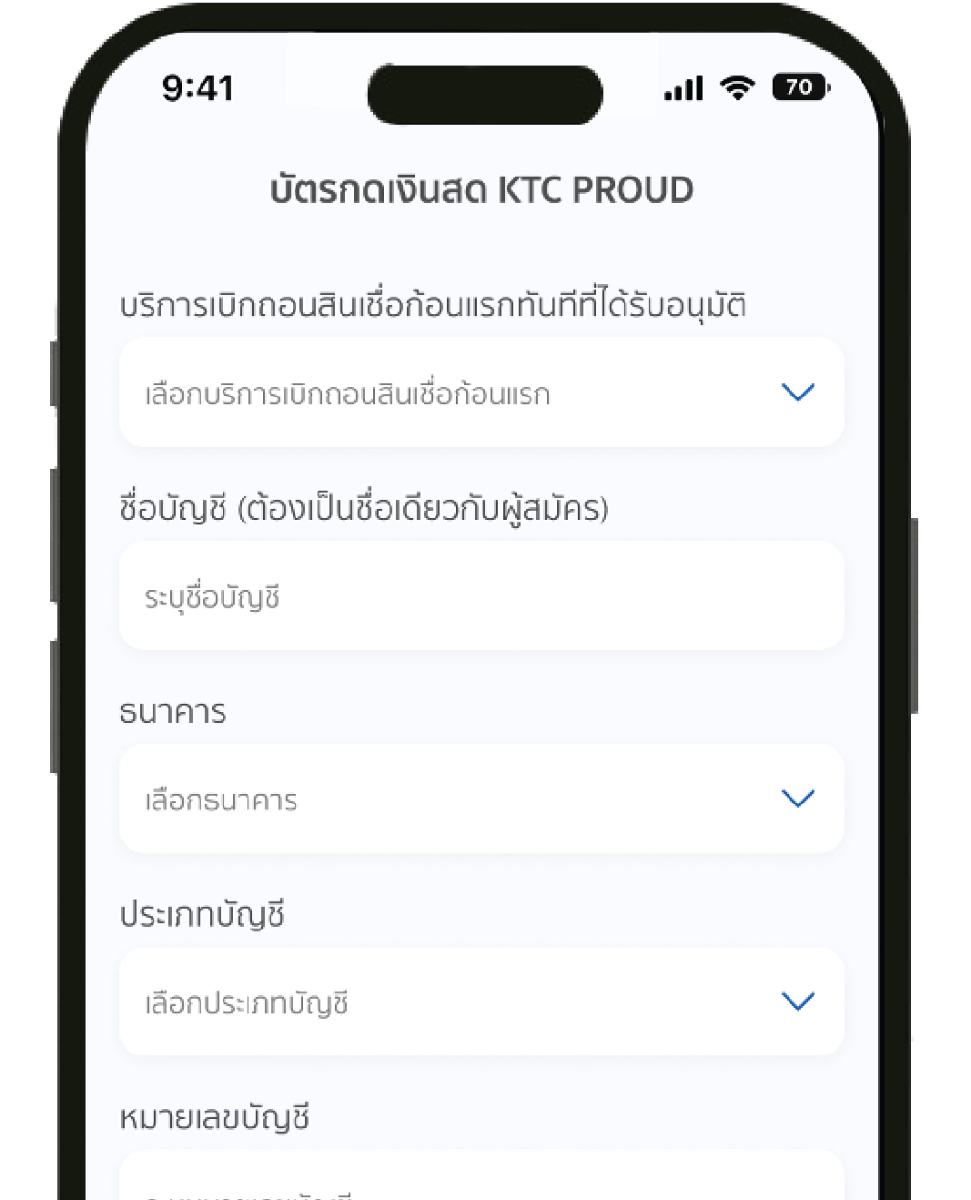

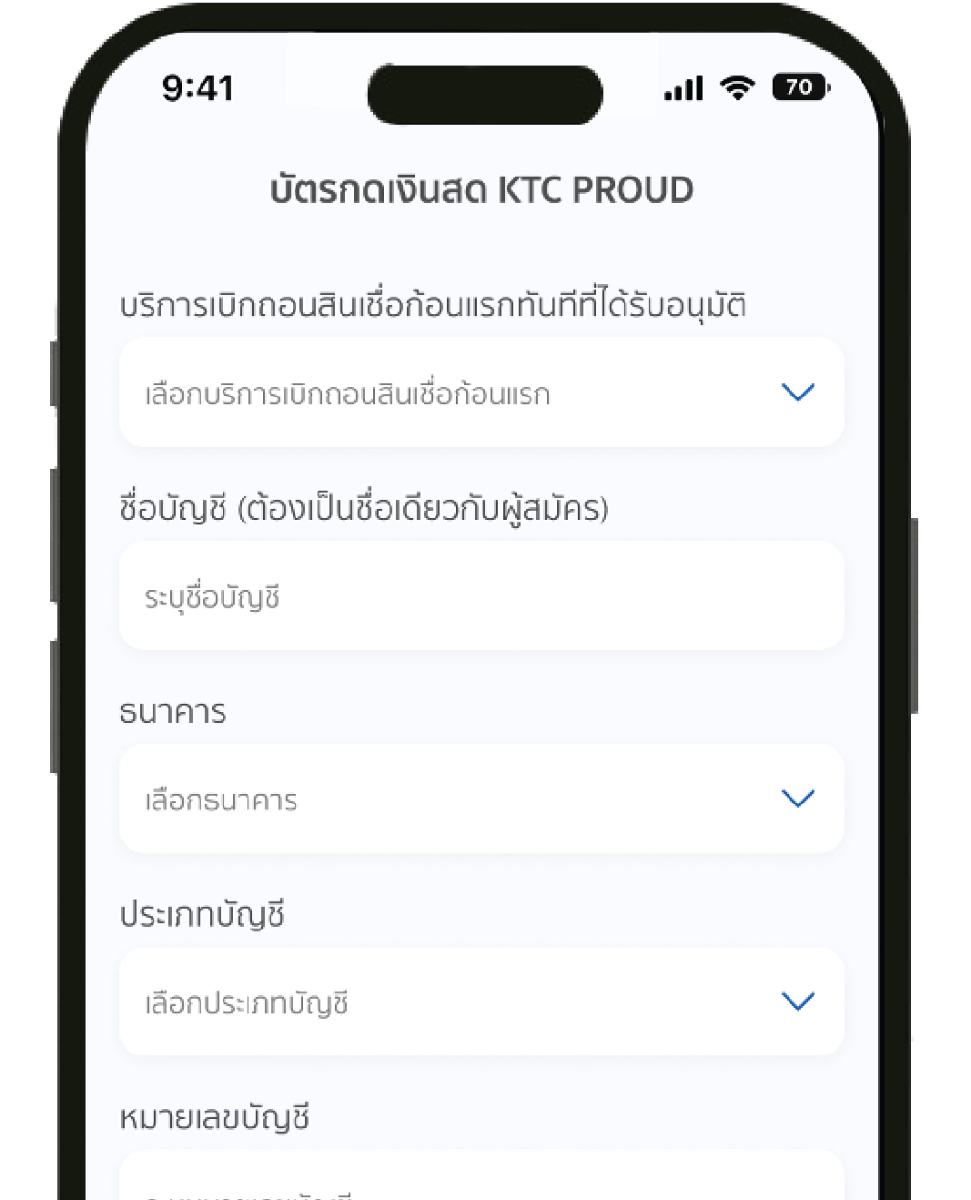

กรอกข้อมูลบริการเบิกถอน

เงินก้อนแรก

สามารถเลือกไม่รับบริการนี้ได้

อัปโหลดเอกสาร

ยืนยันตัวตน

ผู้ใช้งานแอป Krungthai Next

สามารถเลือกช่องทางนี้ได้ หากต้องการเลือกแอปธนาคารอื่นให้เลือกยืนยันตัวตนผ่าน NDID โดยคุณต้องเคยสมัครบริการ NDID มาก่อน

เพียงเตรียมบัตรประชาชนตัวจริง

และไฟล์ภาพเอกสารแสดงรายได้

แล้วทำตามขั้นตอนนี้ได้เลย

กรณีสมัครไม่เสร็จในคราวเดียว สามารถกลับมาทำรายการต่อโดยเลือก “เข้าสู่ระบบ เพื่อทำรายการสมัครต่อ”

บัตรประชาชนที่ใช้ต้องเห็นข้อมูลบนบัตรชัดเจน

และยังไม่หมดอายุ

กรอกข้อมูลให้ถูกต้องครบถ้วนตามที่ระบบต้องการ

สามารถเลือกไม่รับบริการนี้ได้

ผู้ใช้งานแอป Krungthai Next

สามารถเลือกช่องทางนี้ได้ หากต้องการเลือกแอปธนาคารอื่นให้เลือกยืนยันตัวตนผ่าน NDID โดยคุณต้องเคยสมัครบริการ NDID มาก่อน

เพื่อสมัครบัตรกดเงินสด KTC PROUD

กรอกข้อมูล

เมื่อคุณกรอกข้อมูลส่วนตัว

นัดรับเอกสาร

เจ้าหน้าที่จะนัดวันเข้ามารับเอกสารการสมัครบัตรกดเงินสด

รอผลการอนุมัติ

โดยใช้เวลาในการดำเนินการพิจารณา ประมาณ 3-5

เพื่อสมัครบัตรกดเงินสด KTC PROUD

1. กรอกข้อมูล

เมื่อคุณกรอกข้อมูลส่วนตัว

2. นัดรับเอกสาร

เจ้าหน้าที่จะนัดวันเข้ามารับเอกสาร

3. รอผลการอนุมัติ

โดยใช้เวลาในการดำเนินการพิจารณารายได้รวมเริ่มต้นเพียง 12,000 บาท / เดือน

ต้องการเงินด่วน ทันใจ

สมัครและเลือกรับเงินก้อนแรก

อนุมัติไวใน 30 นาที

(สมัครในเวลา 8.00-19.30 น.)

เตรียมบัตรประชาชนตัวจริง

และไฟล์เอกสารให้พร้อม แล้วเริ่มสมัครได้เลย

สแกนเพื่อสมัครบัตร

รายได้รวมเริ่มต้น 12,000 บาท

ต้องการเงินด่วน ทันใจ

สมัครและเลือกรับเงินก้อนแรก

อนุมัติไวใน 30 นาที

(สมัครในเวลา 8.00-19.30 น.)

เตรียมบัตรประชาชนตัวจริง

และไฟล์เอกสารให้พร้อม แล้วเริ่มสมัครได้เลย

เคทีซี จะพิจารณาอนุมัติวงเงินสูงสุด 5 เท่าของรายได้ (ขั้นต่ำ 10,000 บาท สูงสุด 1,000,000 บาท)

สินเชื่อบุคคลมี 2 ประเภท ลูกค้าสามารถเลือกสมัครสินเชื่อที่เหมาะสมกับความต้องการของลูกค้า ดังนี้

1. สินเชื่อบัตรกดเงินสด KTC PROUD เป็นสินเชื่อที่อนุมัติวงเงินประเภทหมุนเวียน โดยลูกค้าสามารถเลือกใช้บริการเบิกถอนเงินสดก้อนแรกเพื่อรับเงินโอนเข้าบัญชีทันทีที่ได้รับอนุมัติหรือไม่ก็ได้ ในกรณีที่เลือกใช้บริการเบิกถอนเงินสดก้อนแรก ลูกค้าจะได้รับบัตรกดเงินสด KTC PROUD เพื่อใช้เบิกถอนเงินสด หรือซื้อสินค้า/บริการได้ตลอดเวลา

โดยดอกเบี้ยจะคิดคำนวณเป็นรายวันนับตั้งแต่วันที่รับเงินโอนเข้าบัญชี/วันที่ทำรายการเบิกถอนเงินสด กรณีลูกค้าไม่ได้ใช้บริการเบิกถอนเงินสดก้อนแรก ลูกค้ายังสามารถเบิกถอนเงินสดผ่านแอป KTC Mobile ได้เช่นกัน

โดยจะได้รับบัตรกดเงินสดเมื่อมีรายการเบิกถอนเงินสด ทั้งนี้ หากลูกค้าไม่ได้ทำรายการเบิกถอนเงินสดภายใน 60 วันนับจากวันที่ได้รับอนุมัติ เคทีซีอาจพิจารณาระงับวงเงินชั่วคราว

2. สินเชื่ออเนกประสงค์ KTC CASH เป็นสินเชื่อที่อนุมัติวงเงินและโอนเงินก้อนเข้าบัญชีธนาคารที่ลูกค้าแจ้งความประสงค์ไว้เพียงครั้งเดียว ซึ่งจะไม่ได้รับบัตรกดเงินสดไว้ใช้จ่าย หรือเบิกถอนเงินสด โดยลูกค้าต้องชำระคืนเงินกู้ให้แก่เคทีซีแบบผ่อนชำระเป็นงวด และเมื่อลูกค้าผ่อนชำระเงินค่างวดแล้ววงเงินจะไม่คืนกลับให้สามารถใช้หมุนเวียนได้อีก

อ่านรายละเอียดได้จาก ช่องทางการชำระเงินของ KTC PROUD

คุณสามารถสมัครขอใช้บริการบัตรกดเงินสด KTC PROUD ได้ โดยสมัครที่ KTC TOUCH หรือสมัครผ่านตัวแทนขายของบริษัทฯ หากมีสินเชื่อบุคคล KTC CASH ไม่ว่าจะเป็นประเภทใดอยู่ก่อนหน้าอยู่แล้ว กรณีที่ได้รับอนุมัติบัตรกดเงินสด เคทีซีจะพิจารณาวงเงินรวมทั้งหมดไม่เกิน 5 เท่าของรายได้ ทั้งนี้ลูกค้าต้องมีสมาชิกภาพสินเชื่อบุคคล KTC CASH เป็นระยะเวลามากกว่า 6 เดือน

เคทีซีจะใช้เวลาประมาณ 5 วันทำการ ในการพิจารณา ทั้งนี้ขึ้นอยู่กับเอกสารและหลักฐานประกอบคำขอสินเชื่อของลูกค้าต้องเป็นไปตามที่เคทีซีกำหนด

ผลิตภัณฑ์บัตรเครดิต

และบัตรกดเงินสด KTC PROUD

ให้คำปรึกษา และอำนวยความสะดวก

ในการสมัครผลิตภัณฑ์ของ KTC

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

ยังไม่มีบัญชีผู้ใช้งาน? ลงทะเบียน