- Overview

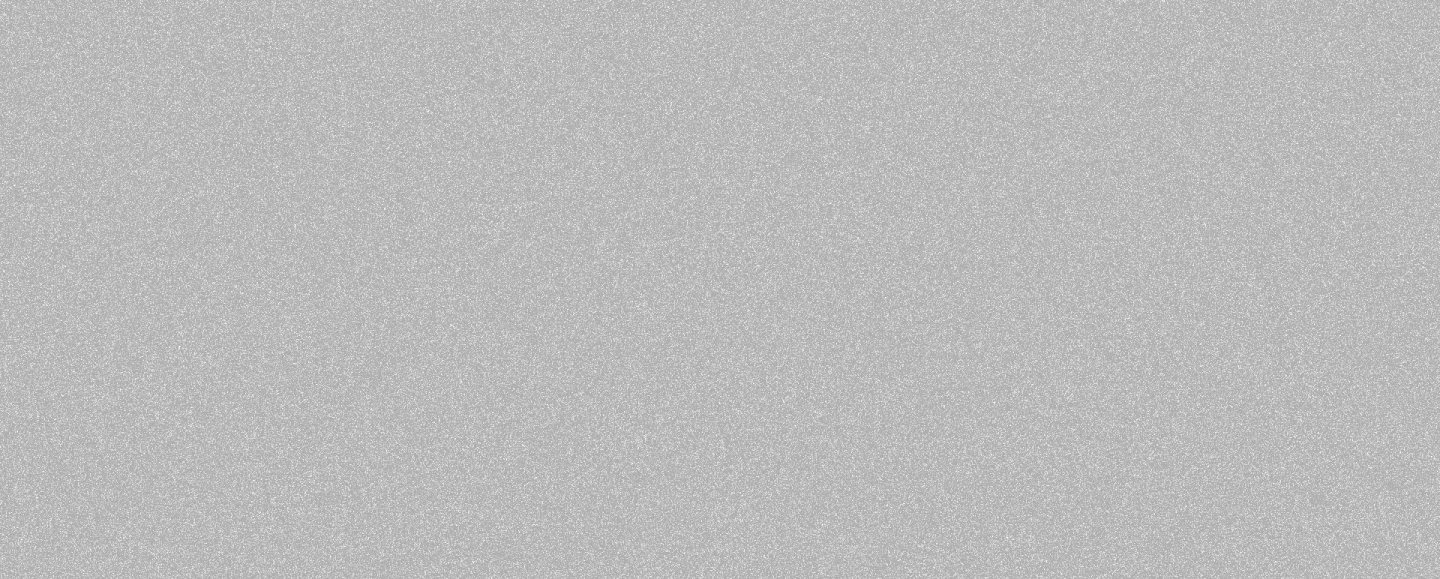

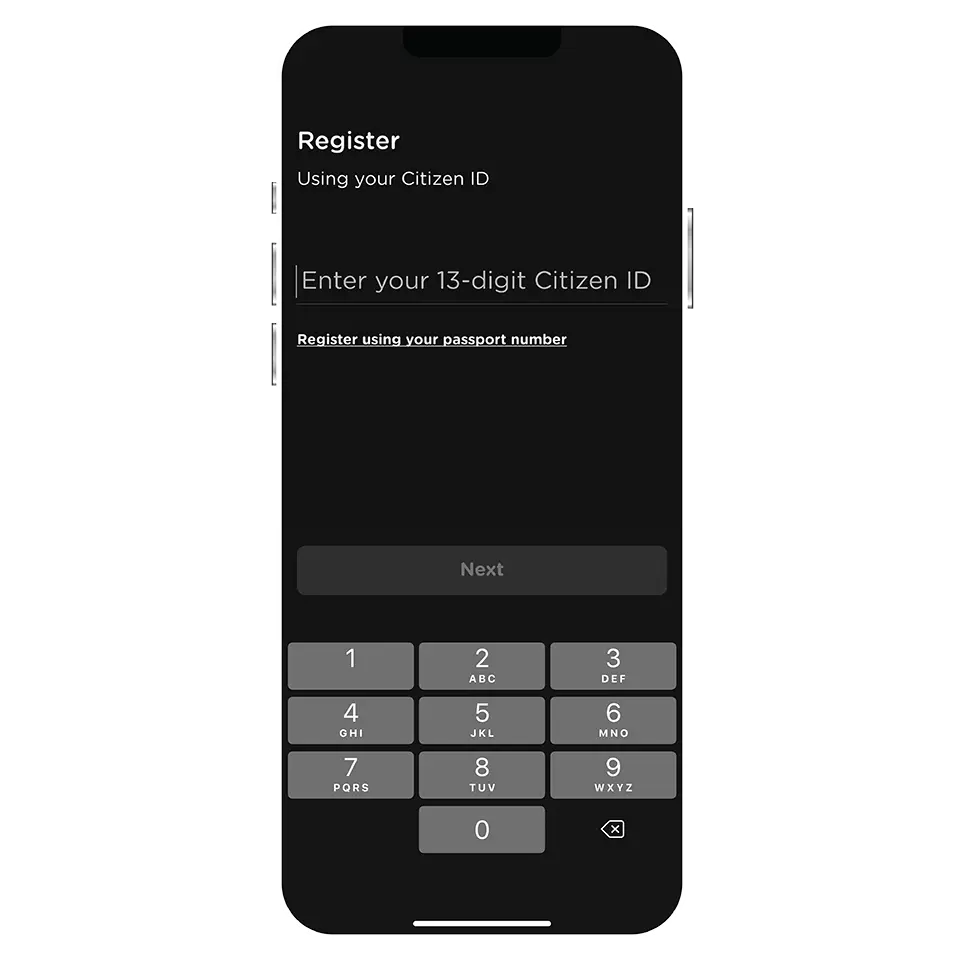

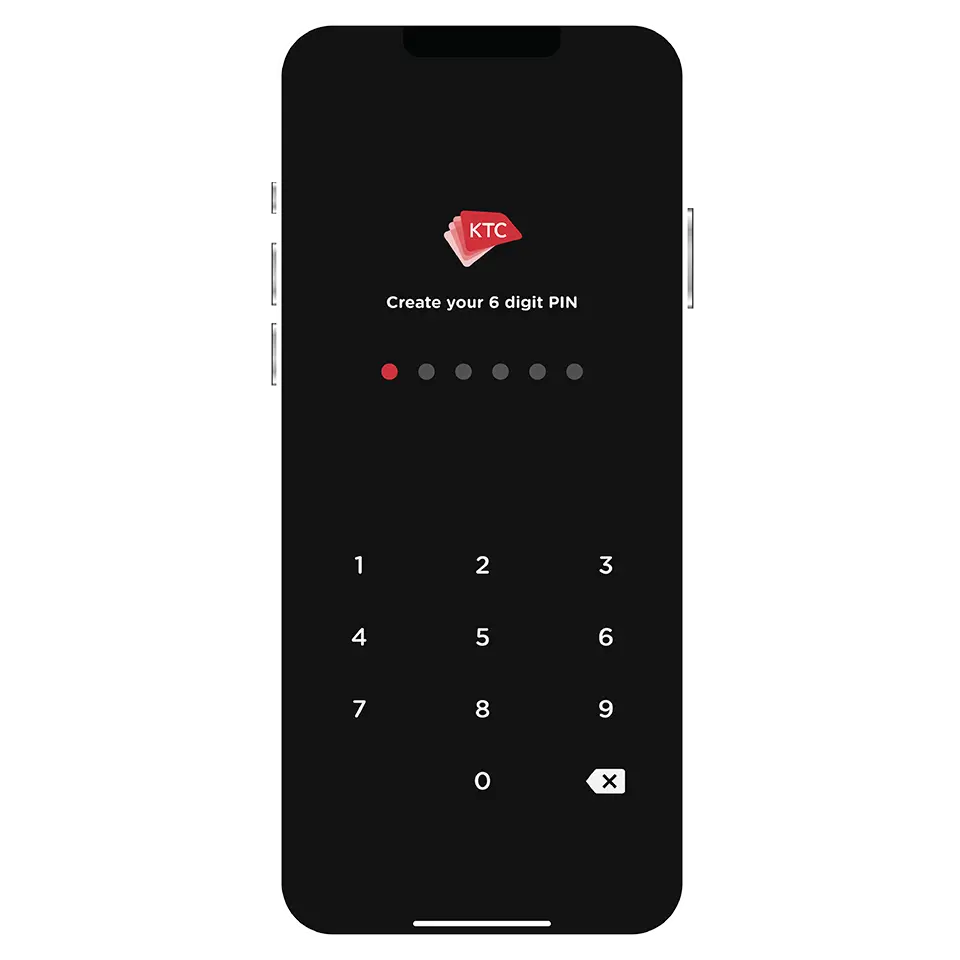

- How to use

- Download

- KTC Online

Complete every moment

with KTC Mobile app.

All KTC products and services are here!

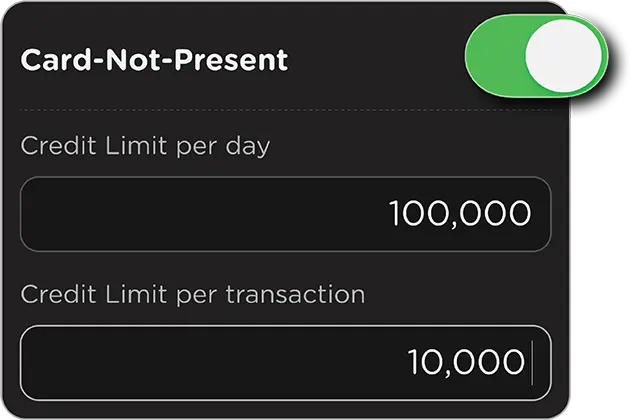

Easily setting your Credit Limit

via KTC Mobile app.

You can customize your Spending Control according to your preferences for security and seamless spending by following these steps:

- Open KTC Mobile app.

- Select the card you want to manage.

- Choose "Card Setting" menu.

- Select "Spending Control".

'Card Not Present Transactions'

include Online Transactions, QR Payment, Online Cash Withdrawal, phone/postal orders, and International Recurring Payments.

Promotions

Promotions

KTC U SHOP

KTC U SHOP

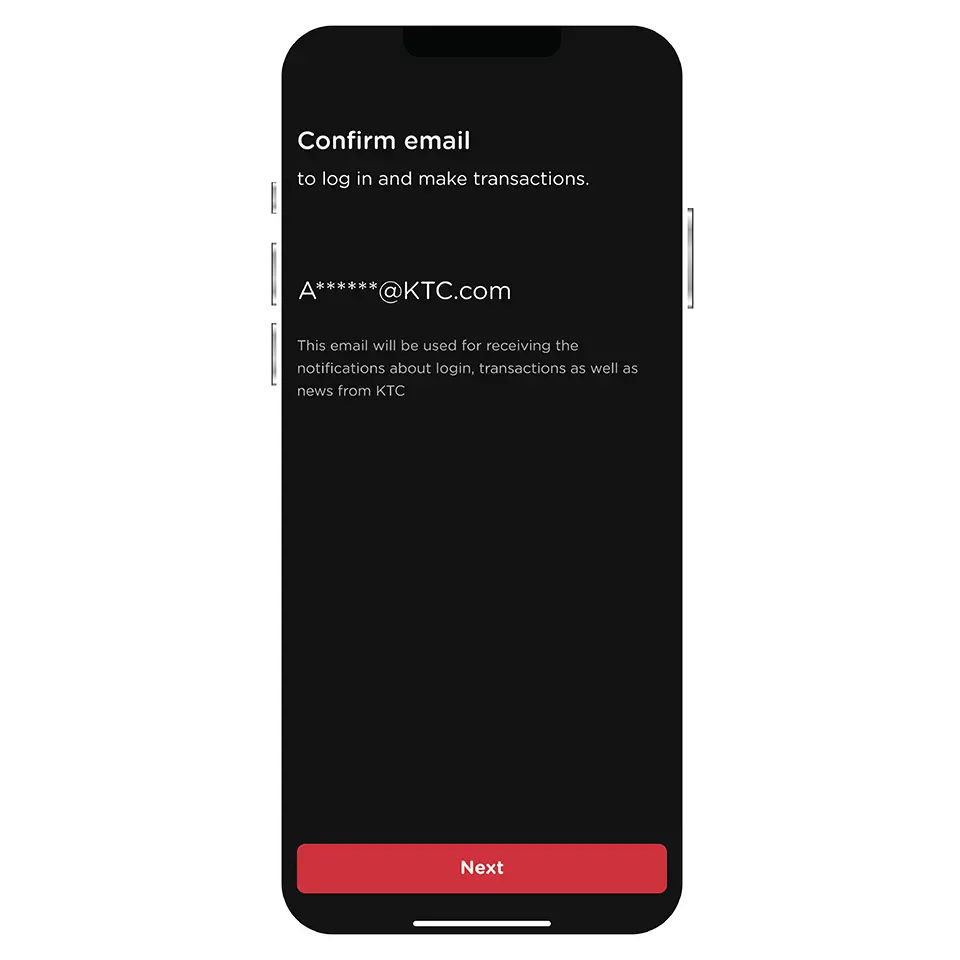

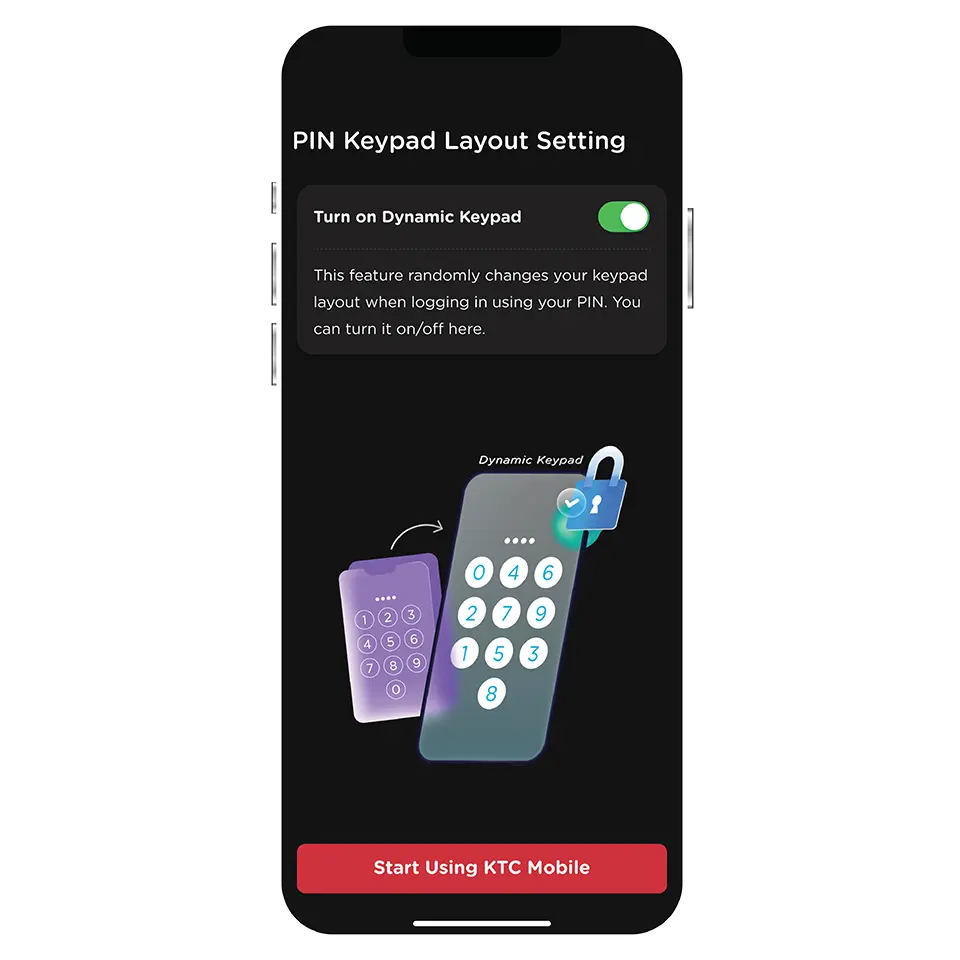

Login

Login