KTC Achieves First-Half Profit and Market Share Growth Across the Board

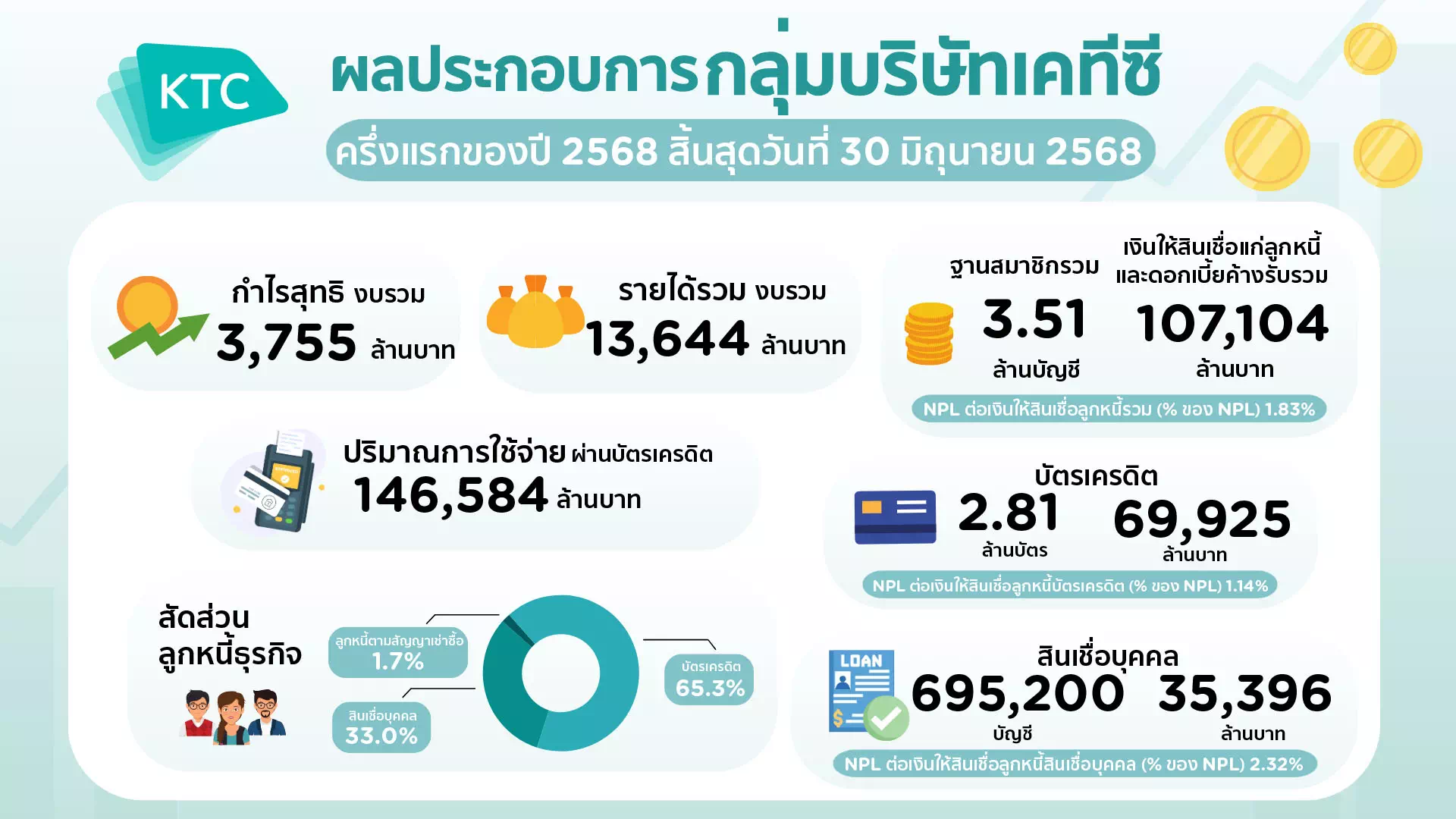

KTC announced the group’s growing net profit for the first half of 2025 of 3,755 million baht, with total loan portfolio of 107,104 million baht, reflecting the business stability and the efficiency of proactive and continuous asset quality management amidst the challenging economic situation. The market share increases in all core products. KTC continues to build a solid financial base to gain more confidence among shareholders and investors.

Mrs. Pittaya Vorapanyasakul, President & Chief Executive Officer, “KTC” or Krungthai Card Public Company Limited, stated, “Thailand economy in the second half of 2025 is likely to face more pressure from uncertainties in the export and production sectors, which are still fragile, both from external and internal factors. The overall consumer finance industry continues to slow down. Nevertheless, KTC still stands strong with outstanding performance and higher market share in all dimensions. KTC's market share over the first 5 months of 2025 compared to the same period in 2024, the credit card receivables increased to 15.4%, while credit card spending increased to 13.3% and the personal loan receivables also increased to 6.8%.”

KTC continues to manage its portfolio quality well despite challenging economic environment and maintains strong and adequate reserves. The NPL Ratio was at 1.83% and the NPL Coverage Ratio was at 419.9%. In Q2/2025, the group’s total revenue increased to 6,812 million baht from interest income and fee income in response to portfolio expansion and card spending volume. Meanwhile, total expenses decreased to 4,340 million baht mainly from good asset quality management and lower finance costs. As such, the group’s net profit in Q2/2025 equaled to 1,895 million baht, a 3.8% increase, and for the first half of 2025, net profit equaled to 3,755 million baht, a 3.5% increase.

“In addition to continuously generating higher profits, KTC also places importance on controlling asset quality throughout the process under the framework of responsible and fair lending, which is the firm foundation that will enable KTC to achieve sustainable growth in the long run. There were the Big Lot trading on June 25, 2025 at amount of 129,204,600 shares and on June 30, 2025 at amount of 243,262,200 shares, accounting for 5.01% and 9.45% of the registered capital respectively. As such, the shareholding structure becomes more diversified where the proportion of domestic and foreign institutional investors increased significantly. This positive change clearly reflects the broad confidence in KTC from various groups of investor. However, Krungthai Bank still remains the number 1 shareholder and continues to support KTC as usual. The board of directors and management structure and the group’s business policies remain unchanged. KTC is still committing to conduct business with transparency and growing a quality portfolio continuously.”

As of June 30, 2025, compared to the same period in 2024, KTC’s total membership base numbered 3,508,827 accounts while total loans to customers and accrued interest receivables equaled to 107,104 million baht (a 1.2% increase). The total non-performing loan (NPL) ratio decreased to 1.83%, comprising 2,813,627cards in the credit card business (a 3.5% increase), and total loans to credit card customers and accrued interest receivables equaled to 69,925 million baht (a 1.0% increase) NPL for credit card was at 1.14%. Total credit card spending volume for the first half of 2025 was 146,584 million baht (a 4.4% increase). There were 695,200 accounts in the KTC personal loan portfolio (a 5.1% decrease), with loans to personal loan customers and accrued interest receivables of 35,396 million baht (a 4.0% increase). NPL for personal loans debtors equaled to 2.32%. The new booking of ‘KTC P BERM Car for Cash’ equaled to 1,048 million baht. ‘Krungthai Leasing (KTBL)’s portfolio equaled to 1,782 million baht (a 29.4% decrease), as KTC has stopped granting KTBL’s portfolio since August 2023 and is currently focusing on debt collection and managing the quality of existing portfolios.

KTC has implemented ongoing debt relief measures per the BOT’s announcement No. TorPorTor. 3/2568 regarding Responsible Lending (RL). The Company assesses each debtor’s repayment capability to ensure no unreasonable increase in their debt burden relative to their original obligations such as converting credit card debt into long-term personal loans, crediting interest back to debtor' credit card accounts, extending the debt settlement period, and reducing monthly repayment amount. For further details, please refer to the link www.ktc.co.th/about/news/measure. Furthermore, as KTC is a Non-Bank business operator, a company under the financial business group of Krungthai Bank Public Company Limited, the Company cooperates with the BOT in measures to assist debtors under the project “Khun Soo Rao Chuay” (You Fight, We Help) Phase 1 and has expanded to Phase 2 project to support fragile debtors to be able to repay debts and finally pay off all debts. Eligible members can register via https://www.bot.or.th/khunsoo from July 1 to September 30, 2025. KTC expected that the debt relief measures mentioned above will not significantly affect the group's overall performance.

The group’s total borrowings (including lease liabilities), equaled to 58,081 million baht comprising 59% of long-term borrowings and 41% of short-term borrowings (including loans and debentures due within one year). The debt-to-equity ratio was 1.64 times, lower than the 1.97 times from the same period last year, and below the debt covenants threshold of 10 times. The available credit line was short-term loans 20,780 million baht and long-term loans from Krungthai Bank 2,000 million baht. KTC is obligated to repay its debentures and long-term borrowings due by the second half of 2025 amounted to 10,000 million baht, resulting in higher liquidity than debt maturity by 2.2 times, which indicating solid liquidity.

Related pictures

Promotions

Promotions

KTC WORLD

KTC WORLD KTC U SHOP

KTC U SHOP

Login

Login