Challenges and Opportunities

Corporate governance is the cornerstone of sustainable growth and the long-term success of any organization. A robust corporate governance framework and process ensure adherence with the core corporate governance principles, including integrity, fairness, transparency, responsibility, and accountability of a business, which are key elements that build upon the confidence of stakeholders. Furthermore, effective governance mitigates the risks of relevant regulatory, operational, and reputational setbacks that could undermine trust or cause potential adverse implications for stakeholders. By embedding good corporate governance at every level of the organization, the Company aims to create a solid foundation for long-term value creation and responsible growth to ensure that the business remains resilient, trusted, and aligned with sustainable development principles.

Key Achievement

- KTC received the “Excellence” award, with 111 score, from the Corporate Governance Report of Thai Listed Companies for the 9th consecutive year

The Company ensures effective management of corporate governance through the following approach.

Corporate Governance Policy

KTC complies with the principle of good corporate governance as guided by regulators such as the Stock Exchange of Thailand (SET) and the Office of the Securities and Exchange Commission (SEC). The Corporate Governance Policy was developed as guidance for the Board of Directors, management and employees at all levels to uphold transparent, fair, and accountable business conduct. The Board of Directors reviews the policy on an annual basis to ensure alignment with relevant laws, rules, and regulations set forth by authorities and appropriateness to the business context.

For additional information, please refer to https://www.ktc.co.th/sustainability-operations/economic-dimension/corporate-governance under the Corporate Governance Policy.

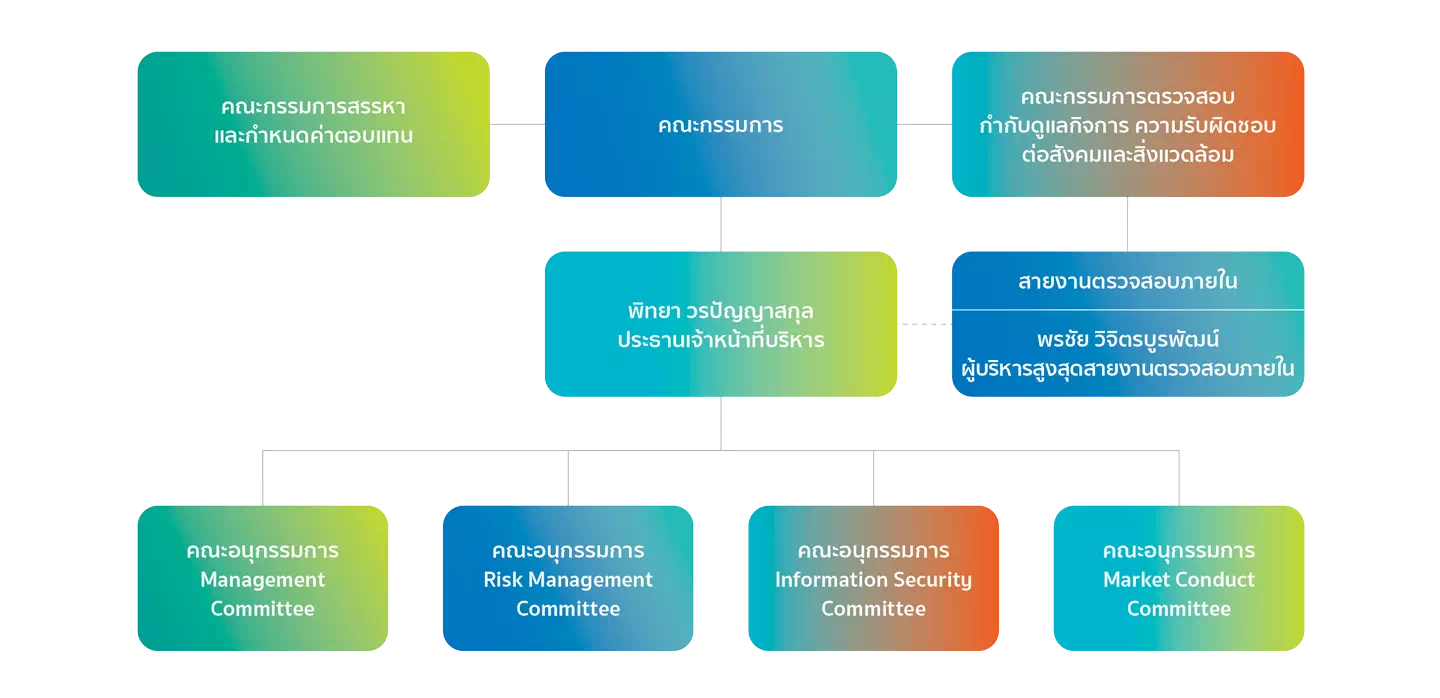

Corporate Governance Structure

As of 31 December 2024, the Company’s corporate governance structure is a one-tier management system comprising of the Board of Directors and two committees namely, the Nomination and Remuneration Committee and the Audit, Corporate Governance, and Sustainability Committee.

Remark:

- The Board of Directors Meeting No. 1/2025 held on 17th January 2025 approved to change the name of the Audit, Environmental, Social Responsibilities, and Corporate Governance Committee to the Audit, Corporate Governance, and Sustainability Committee.

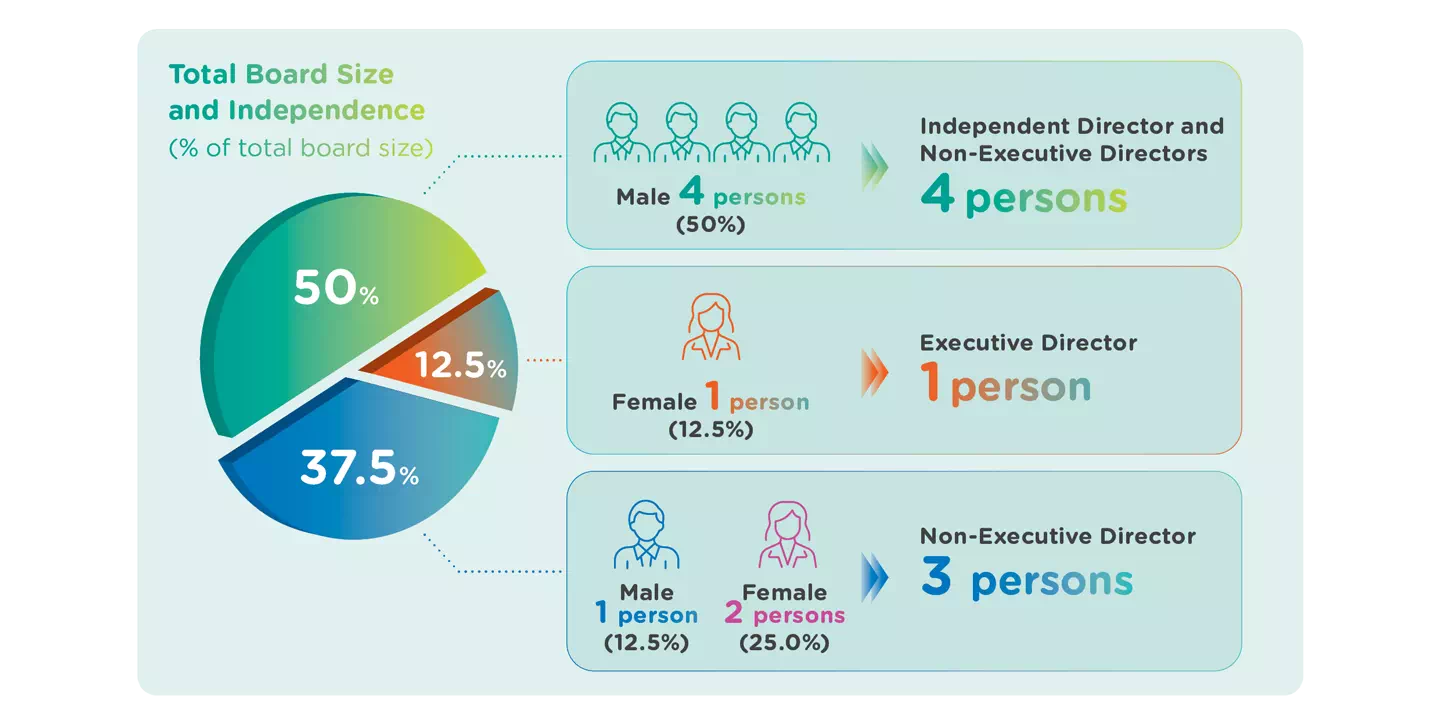

Board of Directors Composition

The Board of Directors is composed of eight members, including three non-executive directors, one executive director, and four independent directors. The Company stipulates a target share of independent directors on the Board of at least one-third of the total board size and no less than three people. The chairperson of the Board is a non-executive and independent director and not the same person as the Chief Executive Officer (CEO). The Company nominates and appoints individual board members annually at the annual general meeting by KTC’s criteria and guidance per the Corporate Governance Policy.

For additional information about the Board of Directors independence statement, please refer to Form 56-1 One Report 2024 under “Corporate Governance Policy” topic.

Board of Directors

The Board of Directors upholds transparent and equitable criteria for nomination and appointment of the CEO. The nominee should possess suitable qualifications, management knowledge, skills, and experience in the credit card business, the finance or banking sector, a financial institution, or other business related to the credit card business. Additionally, the nominee must have an overarching vision and management philosophy suited to the Company’s businesses.

Chief Executive Officer (CEO)

CEO performance evaluation is conducted annually to determine compensation, taking into account various key performance indicators that are defined based on annual business strategies and goals. This includes sustainability-related metrics. As a result, performance or achievement of material environmental, social, and governance issues is also linked to and considered for the evaluation outcome.

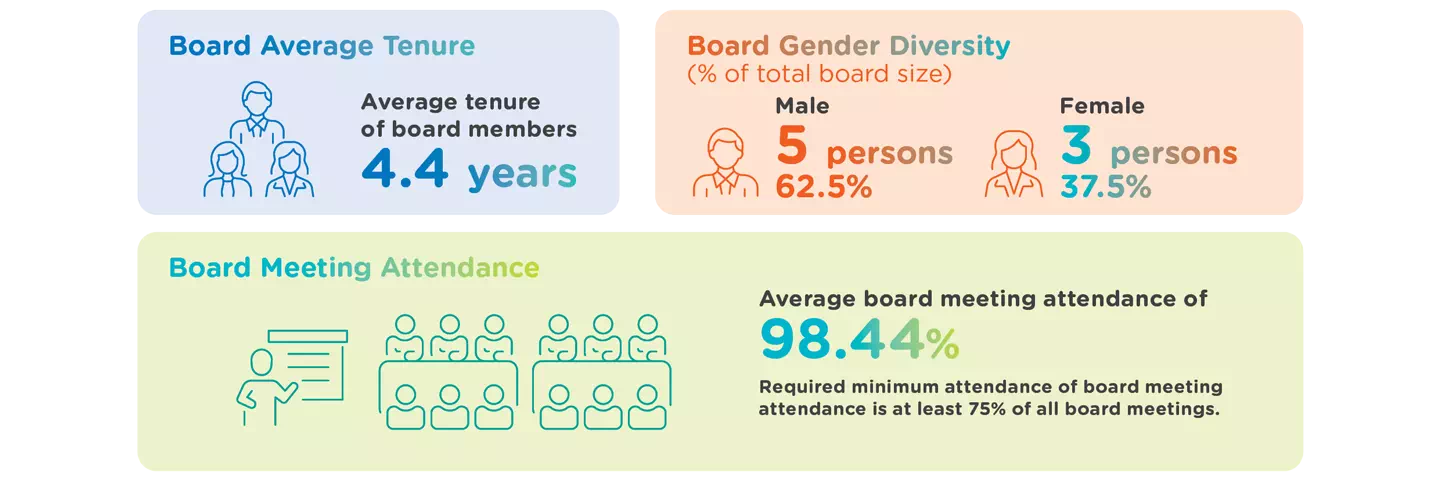

Board Effectiveness

Board of Director Mandates

Board of Director member should hold mandate in no more than five other listed companies on the Stock Exchange of Thailand to ensure the organization’s effectiveness in line with good corporate governance principles.

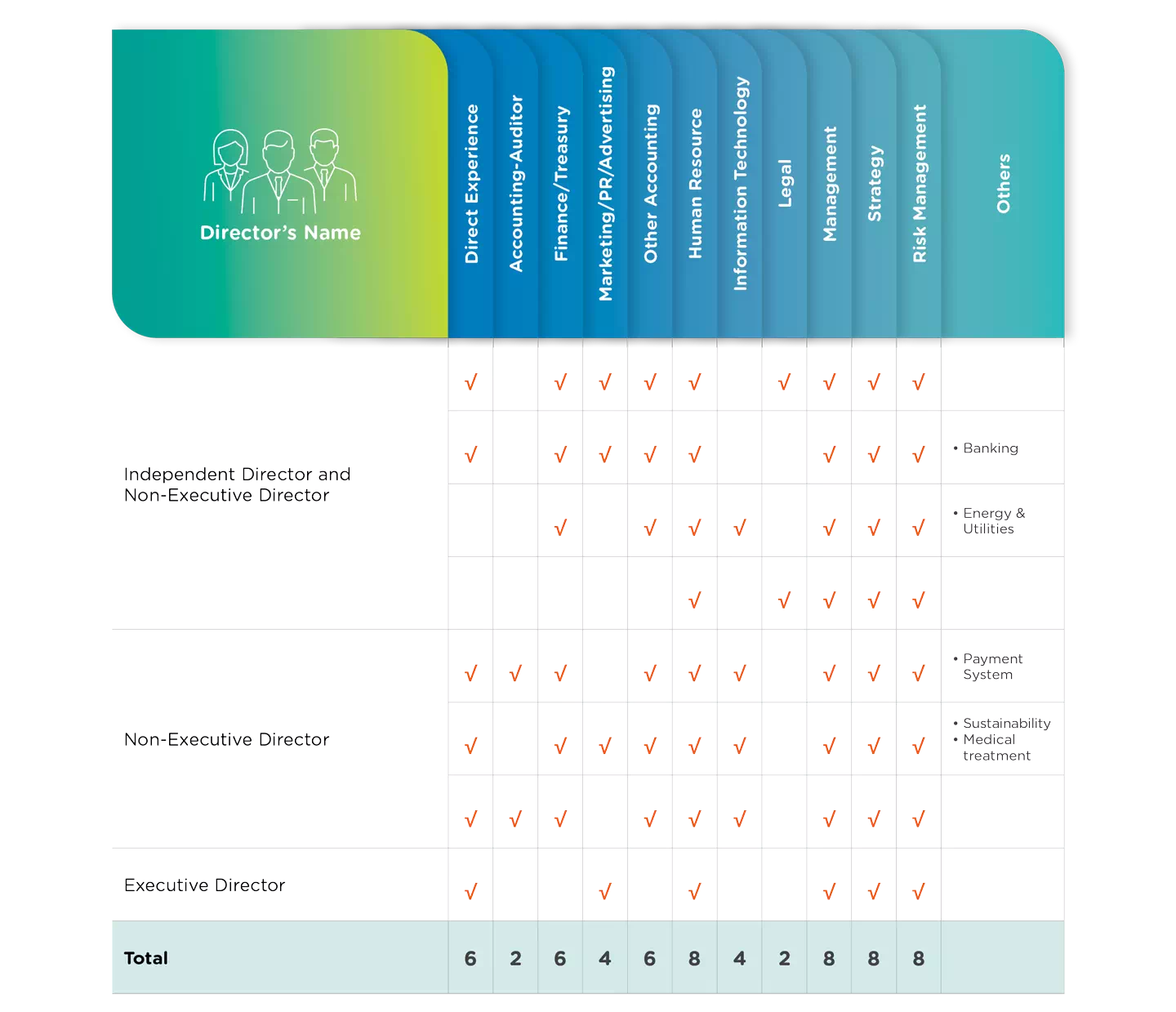

Board Skills Matrix

Upon board nomination process, the nominee must uphold specific qualification requirements and not possess forbidden characteristics per the guidelines of the Stock Exchange of Thailand, the Office of the Securities and Exchange Commission (SEC), or other concerned authorities. The nominee is selected transparently, possessing suitable knowledge, skills, and experience as required by the Company regardless of sex, gender, race, nationality, or religion, where proportion, number, and diversity are considered appropriate in each division. The Board of Directors established a Board Skills Matrix that encompasses knowledge, skills, expertise, and experience to be used as a tool in assessing the qualifications of current board members and for future board member recruitment to enhance corporate governance and ensure the achievement of business strategies as outlined below.

Disclosure of remuneration of Directors, President & Chief Executive Officer (CEO), Top Management and employees

The Nomination and Remuneration Committee proposes remuneration guidelines and policy and determines compensation pay and other benefits for directors, top management, and committee members to the Board for consideration and approval. Such remuneration packages commensurate with roles and responsibilities and are consistent with practices of other companies in the same business, operating performance, and market conditions.

Company has disclosed remuneration of directors, CEO, top management and employees in Form 56-1 One Report 2024 under “Corporate Governance Structure and Material Facts related to the Board, Committees, Executives, Employees and Others” and “Report on Key Operating Results related to Corporate Governance” topics.

The Company’s Securities Holdings

1. Share Ownership (Shareholding of the Company)

The Company does not forbid any director, management, or employee from trading or owning shares issued. Individuals involved in buying, selling, or transferring shares issued by the Company shall abide by relevant SEC notifications or corporate announcements

2. Government Ownership

As a major shareholder of the Company, Krungthai Bank’s voting rights accounted for 49.29% of the total number of voting rights as of 31 December 2024. Moreover, the Company did not offer a golden share offering to major shareholders or the government.

For additional information about the Company’s shareholding structure, please refer to Form 56-1 One Report 2024.

3. Voting Right

The Company stipulates that an equal voting right shall be granted to each common share(1) under the one share, one vote principle, with no limitation on voting rights. A resolution is passed if a majority of votes cast is in favor, unless stated otherwise in the articles of association or set forth otherwise in the relevant law.

In 2024, voting rights of the Company are as follows:

| Votes per share | Amount of Shares | Voting Power (=Votes per share x Amount of Share) |

|

|---|---|---|---|

| No vote (2)(3) | 0 | 109,229,007 | 0 |

| One vote | 1 | 2,469,105,063 | 2,469,105,063 |

| Total | 1 | 2,578,334,070 | 2,469,105,063 |

(1) The Company does not have preferred shares

(2) Exclude treasury shares with no voting rights

(3)Thai NVDR Co., Ltd. belongs to a class of shareholders ineligible to cast vote in shareholder meeting. As at 31 December 2024, Thai NVDR held 4.24% of total shares outstanding

The Company has prepared its accounts and financial statements in accordance with the Financial Reporting Standards and Generally Accepted Accounting Principles in the kingdom of Thailand. It adopts the revised and new Financial Reporting Standards including accounting guidance issued by Federation of Accounting Professions which are effective for the accounting periods. The Company regularly discloses financial Information, key financial ratios, and principal accounting policy in financial statements as well as management discussion and analysis (MD&A) on a quarterly.

Krungthai Card Public Company Limited and its subsidiaries (“Company”) formulate the tax policy under the principles of good corporate governance in order to ensure that their business operations can continue to grow in a stable and sustainable manner. With regard to tax practices, the Company adheres to the principles of accuracy, transparency, social responsibility and equitable treatment towards all stakeholder groups. As designated by the Board of Directors, it is incumbent upon the Audit, Environmental, Social Responsibilities, and Corporate Governance Committee to dutifully perform various tasks set out in the Charter of the Audit, Environmental, Social Responsibilities and Governance Committee, and the Committee is thereby responsible for approving the tax policy.

Promotions

Promotions

KTC WORLD

KTC WORLD KTC U SHOP

KTC U SHOP

Login

Login