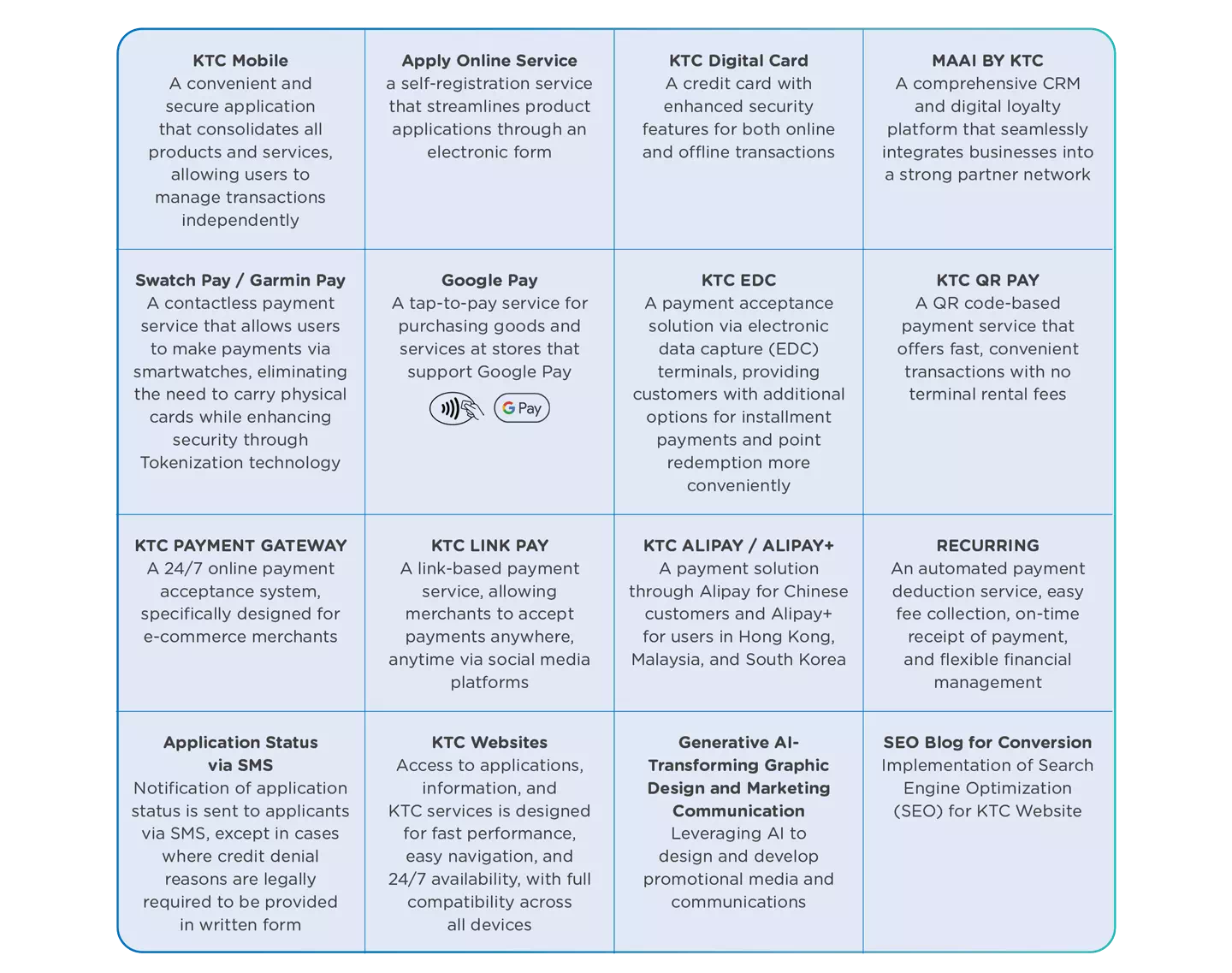

The Company continues to focus on enhancing the

efficiency and effectiveness of marketing

communications

through a variety of digital marketing strategies to

present information about the Company’s products and

services while also building continuous customer

relationships. This approach ensures that the

Company

can reach and meet customer needs according to its

objectives. The use of Paid Media on online

platforms

helps facilitate quick and easy access to

information

for customers. Furthermore, the Company improved its

website to ensure a modern interface, fast loading

speeds, easy information retrieval, and enhanced

Search

Engine. In addition, the Company applied social

media

marketing, email marketing, and mobile marketing,

with

cautious media selection to effectively deliver

product,

service, or promotional information that aligns with

customer interests at the right time. The Company

also

develops Content Marketing by creating valuable

articles

covering a wide range of topics, including products

and

services, financial management insights, and various

lifestyle content, to meet customer needs

comprehensively and provide a meaningful customer

experience.

KTC is also committed to developing a

digital workplace to enhance employee flexibility

and

improve the efficiency and speed of customer

service.

Additionally, the Company is preparing its IT

infrastructure to support online business growth,

where

all selected solutions must underpass rigorous

testing,

such as the Proof of Concept (POC). Identified pain

points and limitations are continuously improved to

maximize efficiency, with a primary focus on

security.

Furthermore, the Company has implemented Robotic

Process

Automation (RPA) to replace resource-intensive

routine

tasks, reducing errors and increasing accuracy. This

also allows employees to dedicate more time to

developing new skills. Subsequently, customers,

merchants, suppliers, and business partners also

benefit

from faster and more convenient services, which

reduce

operational time. Additionally, the use of RPA helps

minimize environmental impact by reducing energy

consumption, paper usage, and other non-renewable

resources. Currently, the Company has deployed RPA

in

over 1,042 processes.

Promotions

Promotions

KTC U SHOP

KTC U SHOP

Login

Login