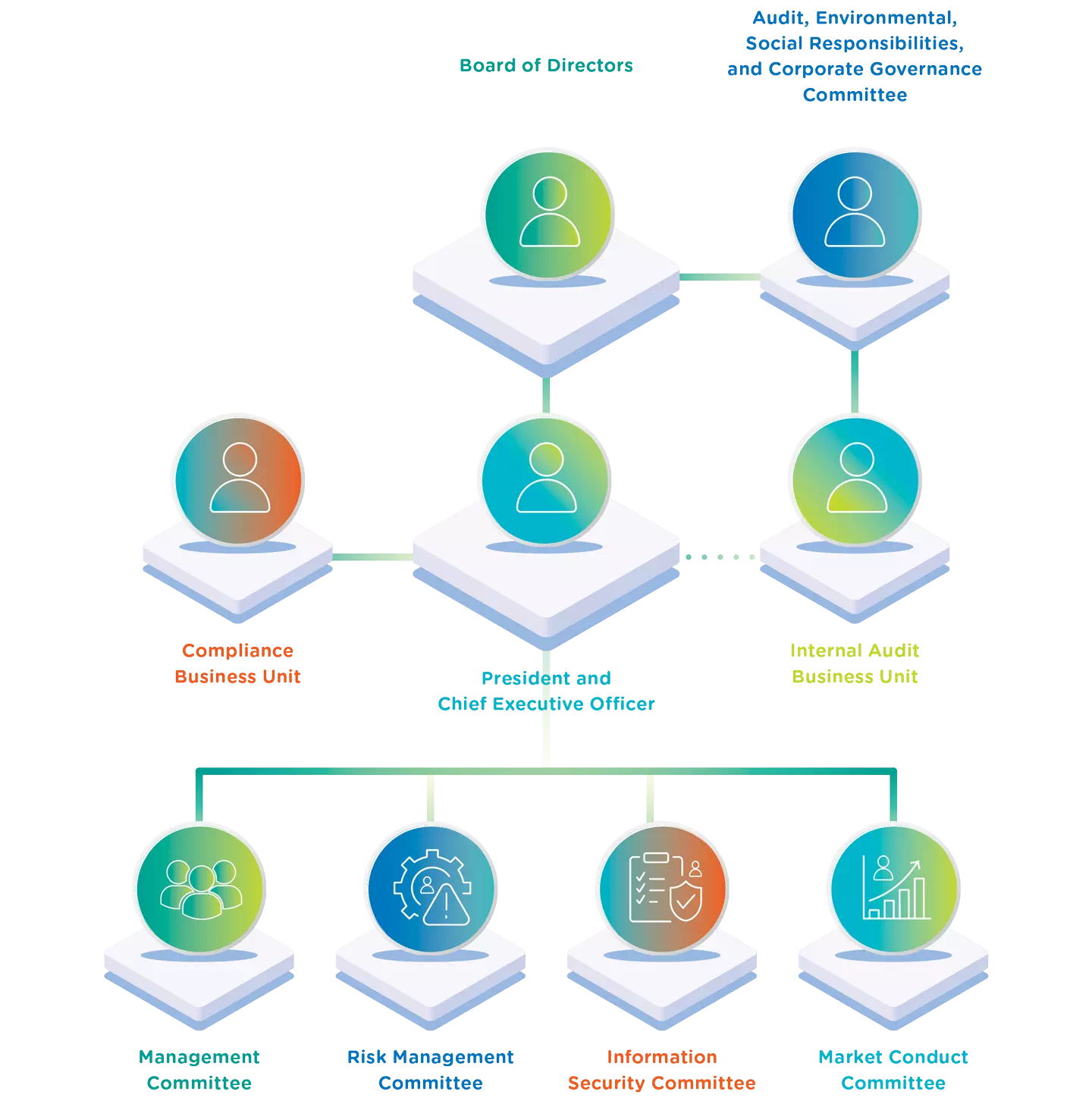

Internal Audit Business Unit

The Internal Audit Business Unit is independent and is

accountable for evaluating the effectiveness of the

1st and 2nd Lines of Defense, as well

as the efficiency of the internal control, risk management,

and corporate governance systems. Findings are reported

directly to the Audit, Environmental, Social

Responsibilities, and Corporate Governance Committee, where

management will use the results from the internal audits to

improve relevant matters.

For risk management process auditing, the Internal Audit

Business Unit is responsible for conducting an annual

assessment of the effectiveness and sufficiency of the risk

management process to ensure that the Company has adopted an

appropriate risk management system. Additionally, external

auditors conduct financial audit and certification while

also verifying compliance with information security and

personal data protection standards, including ISO/IEC

27001:2013 and ISO/IEC 27701:2019, as well as the Payment

Card Industry Data Security Standard (PCI DSS). This ensures

that the Company implements an appropriate risk management

system, covering various aspects of risk management to help

the organization understand risks and control processes

systematically.

Promotions

Promotions

KTC U SHOP

KTC U SHOP

Login

Login