99 of Net promoter score of customer satisfaction survey for KTC TOUCH services

99 of Net promoter score of customer satisfaction survey for KTC TOUCH services

99.2 of Net promoter score of customer satisfaction survey for KTC TOUCH services

Building trust with customers is fundamental to a company’s success and sustainability. When a company fails to meet customer needs or conduct its operations responsibly, it risks damaging its competitiveness, reputation, and overall business performance. KTC addresses this by consistently developing customer-centric products, services, platforms, and privilege programs that are designed to meet member needs, enhance spending value, and foster satisfaction. KTC ensures that every interaction strengthens loyalty and wins their hearts by offering solutions that resonate with customers’ lifestyles and priorities. This trust elevates the customer experience and establishes a strong bond that drives stable and sustainable organizational growth, reinforcing the KTC brand as a trusted partner in enriching lives.

With a focus on enhancing service quality and sustaining member confidence, the Company’s business and customer relationship strategies encompass two main pillars:

KTC upholds responsible lending practices and fair market conduct including responsible advertising or marketing of products and services. KTC strongly emphasizes every stage of business operations Ñ from designing, advertising, and marketing of products to issuing credit cards and extending new loans to align with customers’ repayment capabilities. By that, the Company strictly complies with the regulations set by authorities, card networks and the established Corporate Governance Policy, the Code of Conduct and relevant corporate guidelines for product and service development. The Company’s Code of Conduct prescribes the corporate commitment to serving customers equitably where advertising and sales promotion activities must be conducted responsibly to avoid causing any potential misunderstanding or taking advantage of the following. All employees are subjected to surpass a Code of Conduct training accordingly.

The Management Committee, Risk Management Committee, and the Board of Directors are responsible for considering business expansion opportunities, launching new products or services, altering service delivery formats, and reviewing product or service details and associated risks on a case-by-case basis before being introduced into the market. Complementing this, the Market Conduct Committee was appointed with responsibilities to oversee policy frameworks, strategic plans, and guidelines to ensure that the Company upholds responsible and fair customer service practices in line with all relevant criteria and guidelines.

KTC’s complaint management mechanism is a critical component that supports the Company’s commitment to continuous improvement. By actively gathering and analyzing customer feedback, the Company can incorporate their insights to ensure that products and services align with their needs and expectations accordingly. KTC established the Customer Feedback Center to consolidate and categorize the feedback, and review the impacts of products and services on customers from various channels.

KTC continues to enhance communication practices and ensure customers receive accurate information with clear explanations. In the event of a customer complaint, the Company will review the potential incident case and impose penalties or issue warnings to sales agents in accordance with its policies and guidelines.

KTC is committed to delivering transparent, accurate, and ethical services by providing clear and comprehensible information that prioritizes customer understanding and avoids promoting excessive debt or misleading incentives. To uphold market conduct principles and provide the best services, KTC continuously trains sales agents to deliver precise and comprehensive product information to build customer trust and enhance customer satisfaction.

KTC conducted the card acquisition training program to enhance the knowledge and customer service capabilities of Contact Center employees. The training covered key topics, including credit cards and personal loans, applicant qualifications and required documents, application assessment criteria, market conduct criteria, and responsible lending. It also includes training on the sale process of products and services, sales conversation standards, operational system knowledge, and compliance with consumer rights. A key focus of the program is ensuring that all customers have fair and equitable access to financial services, free from deceit, coercion, harassment, or exploitation in any form. By equipping employees with in-depth knowledge of these principles, the program reinforces the Company’s commitment to protecting customer interests and fostering trust in financial transactions. This training program strengthened the knowledge of Contact Center employees, ensuring they provide accurate, transparent, and fair financial information, reinforcing the Company’s commitment to responsible and ethical service delivery.

KTC organized the 2024 Outsource Sales Conference, featuring an impactful seminar on “Heal Heart Smart Sales: Level up Your Sales and Boost Happiness” seminar. This event was organized for sales agents, selected from over 300 participants nationwide, to inspire and empower them to achieve their sales career goals. The seminar featured inspiring talks about growth mindset and happiness guide which can help unlock sales potential and drive success. The event also included an open session for the sales agents to exchange perspectives and share their professional and personal goals. It also enhanced their knowledge and understanding of various soft and hard skills to boost their sales potential and competitiveness, including negotiation techniques, stress management, and emotional intelligence to improve their efficiency and effectiveness in sales approaches.

As a financial service provider, the Company also ensures that all employees, including sales agents, are knowledgeable about market conduct, fair lending, and consumer rights to support its business operations.

In 2024, the Company organized a training program on customer service per responsible lending per the guidelines set forth by the Bank of Thailand. The training indicator measures the knowledge and understanding of 100% of employees. All 100% of employees surpassed this training program and attained a 100% score on the post-training assessment. During the training, participating employees received the following benefits.

To assess and enhance customer experiences, customer satisfaction evaluations were performed for the following products and services.

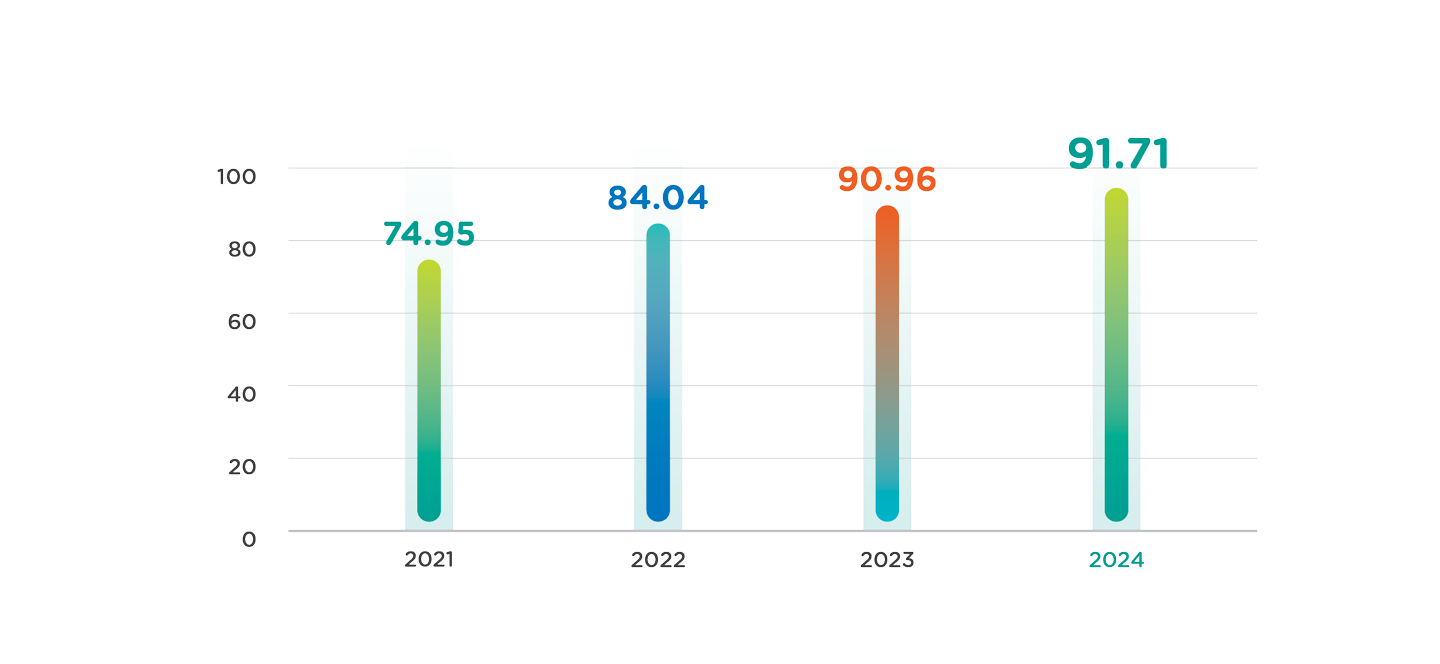

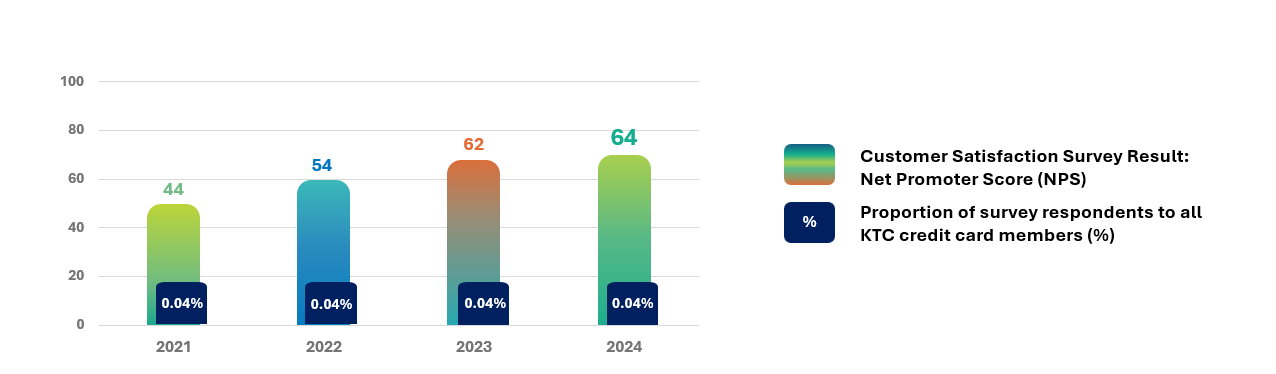

KTC prioritizes understanding and enhancing customer experiences by conducting an annual credit cardholder satisfaction survey using the Net Promoter Score (NPS) tool since 2018. This survey measures customer satisfaction and loyalty by assessing their likelihood of recommending KTC credit cards to others. The survey results are analyzed and considered to further improve credit card product and service offerings as part of the Company’s annual development plan.

Over the years, the survey results shows consistent increase in the number of satisfied customers, reflecting the effectiveness of KTC’s customer-centric approach. This is driven by the continued success of KTC credit cards’ exclusive privileges tailored to the members’ lifestyles and everyday spending. KTC FOREVER points redemption also enables customers to reduce expenses across a wide range of products and services through a simple and user-friendly process. Furthermore, advancements made to the features of KTC Mobile application have enhanced the convenience and transaction efficiency to foster smooth and intuitive credit card experiences for users. These efforts strengthened customer satisfaction and encouraged members to recommend and advocate for KTC brand confidently.

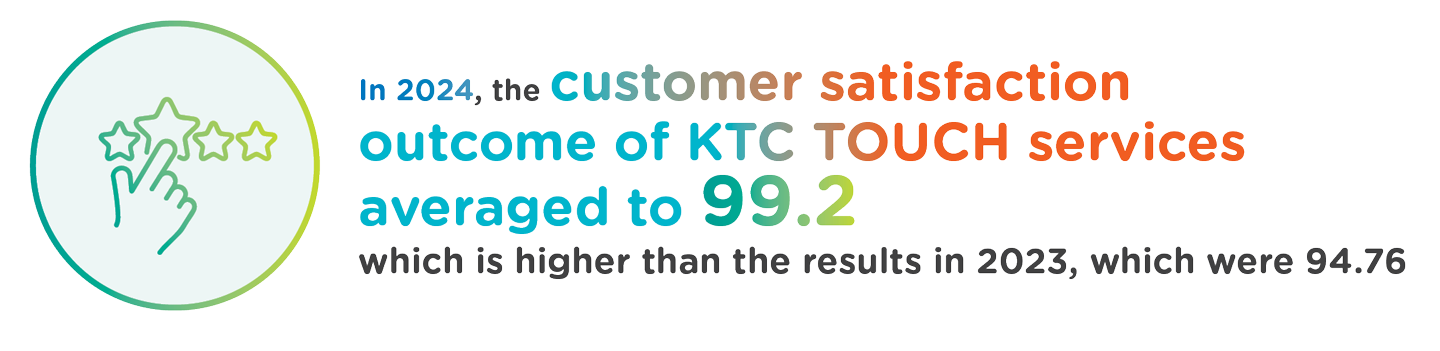

The Company conducts customer satisfaction survey for the KTC TOUCH services using the Net Promoter Score (NPS) as a key performance metric. The survey results are reported to the Company’s management monthly to ensure regular oversight of service quality. If the satisfaction score is lower than the established threshold, the Company will proactively review customer feedback and identify improvement areas accordingly.

The Company regularly conducts monthly satisfaction surveys on service delivery of sales agents who are responsible for presenting accurate and complete information about KTC products, privileges, fees and interest rates as described in the sales handbook and market conduct policy. This monthly survey also evaluates service quality, staff attire and mannerism.

When customer suggestions are received, the Company emails the feedback to the responsible unit. The evaluation results are then analyzed to enhance service quality, refine sales presentation etiquette, and improve training programs, coaching techniques, and information updates. The Company also enforces warnings and penalties as stipulated by its regulations and market conduct guidelines to uphold service standards among sales agents. These measures ensure accurate and clear product information, fostering customer confidence and loyalty to the Company’s products.

The Company conducts a satisfaction survey each time that a customer uses KTC contact center services. If the satisfaction evaluation results are below established criteria, the Company will consider incorporating the results to help and solve problems or concerns for customers promptly, and find a preventive approach for any recurrence. Additionally, the Company regularly evaluates internal service quality to enable prompt corrections and continuous service improvements annually.

Additionally, the Company implements workforce planning to ensure optimal customer service across varying periods and evolving circumstances. Continuous training programs are provided to enhance employees’ knowledge of the Company’s products and services, equipping them with the expertise to deliver exceptional service. Moreover, KTC fosters a positive and engaging work environment, enabling employees to extend that sense of fulfillment and satisfaction to customers, ultimately enhancing the overall customer experience.